HDFC hikes home loan interest rates to 8 65%.

Table of Content

The maximum repayment tenure depends on the type of housing loans you are availing, your profile, age, maturity of loan etc. SURF offers an option where the repayment schedule is linked to the expected growth in your income. You can avail a higher amount of loan and pay lower EMIs in the initial years. Subsequently, the repayment is accelerated proportionately with the assumed increase in your income.

Repo is the rate at which Reserve Bank of India lends funds to commercial banks when needed. This is the third hike since the beginning of the current financial year, taking the rate is back to pre-pandemic levels in order to tame the inflationary pressure. IFC, a member of the World Bank Group, has extended a $400-million loan to India's largest mortgage lender, HDFC, to boost green housing in the affordable segment. IFC's funding will help HDFC especially focus on its green affordable housing portfolio, with 75% or $300 million of the proceeds earmarked for this sector. The non-banking finance company’s best rates are available only for applicants with credit score of 800 and above.

Can I get an approval for a home loan while I decide which property, I should purchase?

You can now apply for a home loan online conveniently from anywhere and at anytime. So start the process of owning your dream home from the comfort of your home. Security of the loan would generally be security interest on the property being financed and / or any other collateral / interim security as may be required by HDFC. The Pradhan Mantri Awas Yojana -Housing for All was a mission that was launched by the Government of India with the aim of boosting home ownership. The PMAY scheme caters to Economical Weaker Section /Lower Income Group and Middle Income Groups of the society, given the projected growth of urbanization & the consequent housing demands in India. For home loans and balance transfer loans, the maximum tenure is 30 years or till the age of retirement, whichever is lower.

Since May this year, India’s apex bank has increased the repo rate by a cumulative 225 basis points as it amps up efforts to tame stubbornly high inflation. These articles, the information therein and their other contents are for information purposes only. All views and/or recommendations are those of the concerned author personally and made purely for information purposes.

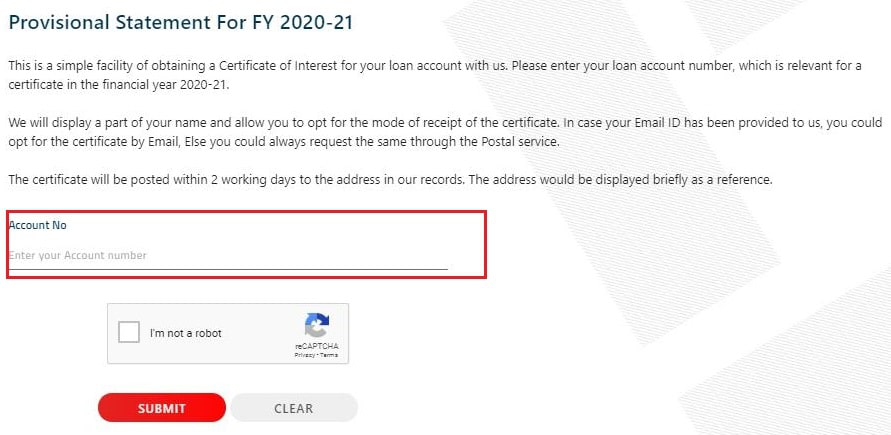

Apply online for a HDFC Home Loan

HDFC is India’s premier housing finance company offering a wide range of home loan products that are customized to your needs and can be comfortably repaid over a longer tenure. HDFC’s end-to-end digital home loan application process, integrated branch network across the county and 24X7 online assistance can make your home owning journey a memorable one. HDFC’s lowest rate on home loan is available for those with a credit score of 800 and above. The country’s largest lender SBI offers a best rate of 8.75% for those with a credit score of 700 and above. ICICI Bank offers similar rates but its minimum credit score is 750. While adjustable rates pass on the full impact of repo rate hikes, the rates are lower for new borrowers because of reduction in spreads.

HDFC will determine your Home Loan Eligibility largely by your income and repayment capacity. Other important factors include your age, qualification, number of dependants, your spouse's income , assets & liabilities, savings history and the stability & continuity of occupation. You can take disbursement of your home loan once the property has been technically appraised, all legal documentation has been completed, and you have made your down payment.

HDFC Home loan prepayment: Pointers to keep in mind

You can apply for a home loan online from the ease and comfort of your home with HDFC’s online application feature. Alternatively, you can share your contact details here for our loan experts to get in touch with you and take your loan application forward. The Borrower will be required to submit such documents that HDFC may deem fit & proper to ascertain the source of funds at the time of prepayment of the loan. If you are already a registered user of The Hindu and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.

Borrowers with a credit score below this cutoff will have to pay anywhere between 8.95% and 9.30% interest on home loans. Go through the list of documents required and keep them ready before starting your home loan application process. HDFC Ltd offers low home loan interest rates starting from 8.20 per cent per annum, the statement said. For those who do not have the required credit score, the interest rate may vary between 8.40 per cent to 8.90 per cent. HDFC said it has earmarked 75%, or $300 million, of the IFC funding for financing green affordable housing units.

We are unable to show you any offers currently as your current EMIs amount is very high. You can go back and modify your inputs if you wish to recalculate your eligibility. Incidental charges & expenses are levied to cover the costs, charges, expenses and other monies that may have been expended in connection with recovery of dues from a defaulting customer. A copy of the policy can be obtained by customers from the concerned branch on request. Passport size photograph of all the applicants / co-applicants to be affixed on the Application form and signed across.

The reset can be according to the financial calendar, or they can be unique to each customer, depending on the first date of disbursement. HDFC may at its sole discretion, at any point during the subsistence of the loan agreement, alter the interest rate reset cycle on a prospective basis. The documentation needed to be submitted along with your home loan application form is available here. This link provides a detailed checklist of KYC, Income and property related documents required for the processing of your home loan application. The checklist is indicative and additional documents could be asked for during the home loan sanction process. “This rate of interest is applicable to home loans, balance transfer loans, house renovation, and home extension loans.

The bank will send you an acknowledgement letter after the whole sum has been paid off to them. It will take a few days for the bank to send you the paperwork, so the NOC and the No Dues certificate will come after. There has been a significant reduction in GST rates on home purchase. Details of ongoing loans of the individual and the business entity including the outstanding amount, instalments, security, purpose, balance loan term, etc. All the information contained herein above is for awareness and customer convenience and is intended to only act as an indicative guide about HDFC’s products and services. For detailed information about HDFC’s products and services kindly visit the nearest HDFC branch.

Once you avail a HDFC home loan, you can access your home loan account online on our website. You can download account statements, interest certificates, request for disbursement and do much more. Our HDFC Reach Loans make home buying possible for micro-entrepreneurs and salaried individuals who may or may not have sufficient proof of income documentation. You can apply for a house loan with minimal income documentation with HDFC Reach. All co-owners of the property need to be co-applicants to the house loan. Plot purchase loans are availed for purchase of a plot through direct allotment or a second sale transaction as well as to transfer your existing plot purchase loan availed from another bank /financial Institution.

"We are keen to increase our footprint in funding affordable and green housing and are committed toward supporting India's efforts for a sustainable and green low-carbon economy." Home loan is a form of secured loan that is availed by a customer to purchase a house. A housing loan is repaid through equated monthly installments which consists of a portion of the principal borrowed and the interest accrued on the same. Home loans have one of the lowest interest rates as compared to other loan products such as auto loans and personal loans. Opt for a home loan provider who offers longer tenure loans, flexible repayment options etc. Interest rates may differ depending upon the loan amount, profession (salaried or self- employed) and your credit score among other factors.

The RBI raised the repo rate by 0.35 percent earlier this month, from 5.9 percent to 6.25 percent. If the home loan is being prepaid after 36 months, no charges will be levied. The following rules will apply to borrowers who are not individuals (i.e., businesses, sole proprietorship firms or HUFs acting as co-applicants). You may easily prepay HDFC home loan online by using the customer portal. I declare that the information I have provided is accurate & complete to the best of my knowledge. I hereby authorize HDFC Ltd. and its affilliates to call, email, send a text throught the Short Messaging Service and/or whatsapp me in relation to any of their products.The consent herein shall override any registration for DNC/NDNC.

Things to Check/Do Before You Apply for a Home Loan

There is no place like 'home' and with HDFC Home Loans you can gather hopes, achieve your dreams and create memories in your own space. For Home Renovation and Top-Up Loans, the maximum tenure is 15 years or till the age of retirement, whichever is lower. For Home Extension Loans, the maximum tenure is 20 years or till the age of retirement, whichever is lower. It is a loan to extend or add space to your home such as additional rooms and floors etc.

Comments

Post a Comment